Semiconductor giant Intel (NASDAQ: INTC ) has been riding a rollercoaster over the last year. Shares have bounced between $19.23 and $26.90; the 52-week high is 40% above the yearly lows. That's a mighty thrill ride for a Dow (DJINDICES: ^DJI ) member with a market cap in the $100 billion range. Compare that to the Dow itself, which is exploring all-time highs on a history-making bullish tear -- and is still only 25% above its 52-week lows.

The rollercoaster continues tonight when Intel reports second-quarter earnings. The chip titan's results tend to unleash huge price swings overnight -- in both directions.

In January's fourth-quarter report, Intel's short-term outlook seemed weak, and Intel shares plunged 7% the next day. With expectations thus set low, Intel traded sideways in the days after the April report -- but that looked like a victory as the Dow slid a full percent at the same time.

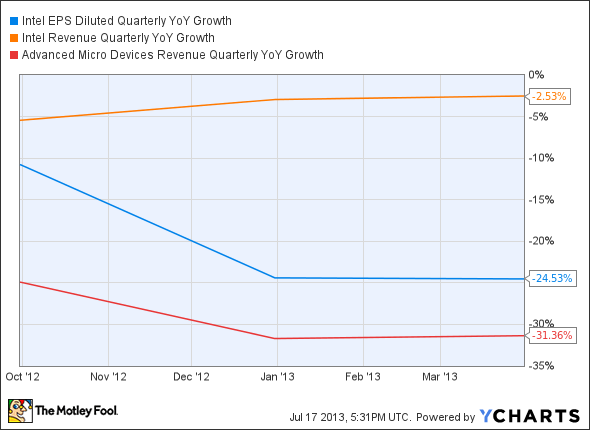

So what are we Intel shareholders looking at tonight? Well, analysts aren't expecting much. Wall Street expects non-GAAP earnings to fall 26% year over year to $0.40 per share. Sales are forecast to come in 4.5% lower at $12.9 billion. These numbers would be roughly in line with the last couple of quarters in this "death of the PC" era. Then again, Intel's top and bottom lines are holding up far better than those of its closest rival, Advanced Micro Devices (NYSE: AMD ) :

INTC EPS Diluted Quarterly YoY Growth data by YCharts.

Intel is finally making a push into mobile computing, but the Haswell wonder-chip is still too new to make any material impact on the June quarter's results. So the story tonight continues to revolve around PC and server systems.

Third-party market-watchers are pouring endless amounts of doom and gloom over the PC sector. We're talking about sales dropping by double-digit percentages year over year in both the first and second quarters. While I do expect AMD to bear the brunt of that plunge, you should clearly not expect great sales of desktop and notebook chips in this earnings report. Intel predicts an upturn in the second half, but even that doubtful prophecy carries no weight in tonight's report.

So in the end, server systems will either save Intel's bacon or not. My investment thesis for Intel rests on commodity server systems becoming more important over time. Cloud-computing services must live on a chunk of hardware somewhere, and even mobile gadgets need to be fed by big-iron back-end servers. And Intel reigns supreme in that sector.

That long-term theory doesn't necessarily spell great things for a single quarter along the way, and I can't promise that the server processors will hold up their end of the deal tonight. But if they don't, and Intel share prices collapse as a result, I'd call it a buy-in opportunity. The stock already trades at a measly 12 times trailing earnings -- deep, rich value-stock territory. And like I said, the long-term story is still strong.

It's incredible how much our digital and technological lives are shaped by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

No comments:

Post a Comment