Editor's Note: MarketMinder does not recommend individual securities; the below is simply an example of a broader theme we wish to highlight. It is not a recommendation to buy, sell or take any other action regarding the specific securities mentioned.

Earnings season is well underway, with 208 S&P 500 firms reporting as of Friday. So what's up with Corporate America? Earnings and revenues, that's what! But while that in and of itself is noteworthy, there is perhaps a more nuanced takeaway we can glean from recent reports. They also put some alleged risks—Ebola, geopolitical turmoil and the many other things dominating headlines—into perspective. Many firms gave their takes on whether current headline-generating risks will impact their bottom lines in Q4 and beyond. The short answer: Most don't think they will.

[Related -Most Investors Will Miss This Powerful Buy Signal on Amazon's Chart]

Thus far in the season, aggregate S&P 500 Q3 earnings per share are estimated to have grown 5.6% y/y—the 20th straight quarter of growth. Revenues are up 3.7% y/y, the sixth straight quarter sales have gone up. Growth has been broad-based, with all but two sectors in the black—Energy and Consumer Discretionary. As for revenues, Energy was the only sector in the red. (Exhibit 1) Now, a weaker Energy sector isn't all that shocking—the sector is more price sensitive than volume and the oil supply glut has weighed on prices (a force that doesn't seem all that likely to change soon). Consumer Discretionary's dip thus far is largely driven by two firms—Ford and Pulte Homes. Those two are dragging down the headline figure, so this may just be a statistical snafu. Leaving these two categories aside, earnings and revenues are generally growing nicely.

[Related -Is Now The Time To Buy Oil?]

Exhibit 1: Q3 2014 Earnings and Revenue Growth by Sector

Source: FactSet Earnings Insight, as of 10/24/2014.

But after reporting these solid results, the firms' quarterly conference calls often shift to discuss executives' take on the outlook for their business. Recently, a tally and discussion of those headline grabbing "risks"—weak eurozone, strong dollar, slower-growing China, Russia/Ukraine conflict, Middle East turmoil and Ebola—caught our eye. Plenty of firms mentioned all of the above, but interestingly, many companies didn't cite these as major negatives. (Exhibit 2)

Exhibit 2: Risks Cited by S&P 500 Companies in Q3 Conference Calls (68 Total)

Source: FactSet Earnings Insight, as of 10/17/2014.

Largely, it seems companies thought these risks wouldn't bite future earnings. Take Ebola. Only one company listed it as a concern (and, surprisingly, it wasn't an airline). But even the outlier—PPG Industries—seemed to put Ebola's impact into perspective, "And in Africa, although it's a smaller part of that overall region for us, both with the port congestion, Ebola and other things..."[i] (Emphasis is ours.) Lately, Ebola gets more mentions than that in about five minutes of TV news coverage. China hard landing and slowdown fears have long swirled, too, so it wasn't surprising to see this mentioned a lot. But what may be surprising is less than a third of companies that mentioned China did so in a negative light! For example, Honeywell said, "China continues to be a strong market for us both on the short and long cycle sides of the portfolio..."[ii] And General Mills shared a similar sentiment: "…we expect Greater China sales growth to strengthen in the remainder of the year."[iii] Eurozone economic conditions also garnered attention, with 65% mentioning the region. But here, too, less than half of the companies highlighting it cited it as a risk. Like Accenture, which didn't view the region as a drag—"In Europe, despite an economic environment that continues to be difficult, we are performing very well in many of our largest countries, including France, Italy, Germany, and the United Kingdom."[iv]

Now, not all firms easily dismissed these factors. Many still overwhelmingly blamed a stronger dollar.[v] For instance, Accenture said, "For the full fiscal year 2015, based upon how the rates have been trending over the last few weeks, we currently assume the impact of FX on our results in U.S. dollars will be negative 2% compared to fiscal 2014."[vi] And quite a few companies still blamed tensions between Russia and Ukraine. Like Halliburton—"We expect our Russia business will continue to face headwinds next year, including the possibility of additional sanctions."[vii]

Sure, some companies might actually believe risk X or risk Y could weigh on future earnings. And it might! But there are factors to weigh here. For one, these are forecasts, and all forecasts are subject to error—even those from folks directly involved with the firm at senior levels. After all, an exec may have bought into a particular story unnecessarily. But also consider: CEOs are talking to analysts, who set expectations for corporate results. CEOs, in turn, report to shareholders—who tend to like results that beat expectations, not miss them. So they are incented to try to keep expectations low, an easier hurdle to clear. Underpromise, overdeliver. To achieve this, they likely find a scapegoat—and when that scapegoat has ample media coverage, it has a high degree of credibility. We aren't suggesting that happens all the time—just that we wouldn't fixate on one quarter or guidance about the following quarter. Rather, look at economic conditions generally and weigh whether the guidance execs are giving makes sense in light of your view of the next 12-18 months.

Earnings season can be noisy. But sometimes the noise and the data can help you see false fears for what they are.

Stock Market Outlook

Like what you read? Interested in market analysis for your portfolio? Why not download our in-depth analysis of current investing conditions and our forecast for the period ahead. Our latest report looks at key stock market drivers including market, political, and economic factors. Click Here for More!

[i] FactSet Earnings Insight, as of 10/17/2014.

Related ABX Markets Debut Week On Negative Note; S&P 500 Falls Through Key Level Benzinga's Top Upgrades M&A Activity Boosts U.S. Stock Futures (Fox Business)

Related ABX Markets Debut Week On Negative Note; S&P 500 Falls Through Key Level Benzinga's Top Upgrades M&A Activity Boosts U.S. Stock Futures (Fox Business)

Agence France-Presse/Getty Images

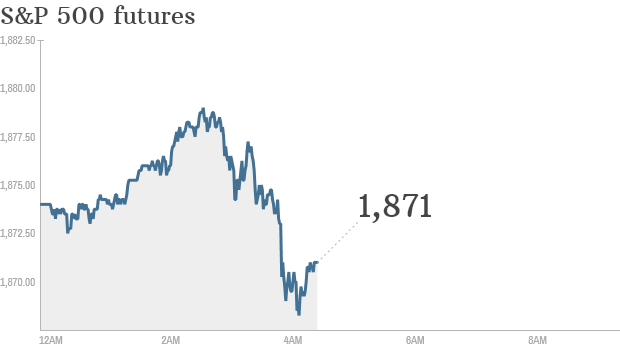

Agence France-Presse/Getty Images  Click chart for in-depth premarket data. LONDON (CNNMoney) There's plenty going on Wednesday. Let's get straight to it.

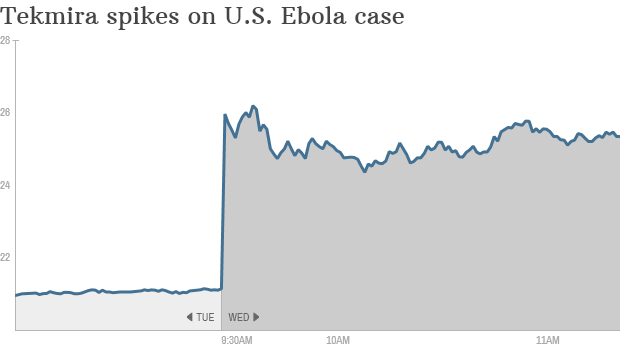

Click chart for in-depth premarket data. LONDON (CNNMoney) There's plenty going on Wednesday. Let's get straight to it.  NEW YORK (CNNMoney) The first confirmed Ebola case in the U.S. is fanning fears around the country, but it's also driving greed in some corners of the stock market.

NEW YORK (CNNMoney) The first confirmed Ebola case in the U.S. is fanning fears around the country, but it's also driving greed in some corners of the stock market.