Asian stocks fell, with the equity gauge excluding Japan posting its first drop in eight days, as signs the U.S. economy is strengthening fueled speculation that the Federal Reserve will soon start tapering stimulus.

Newcrest Mining Ltd. (NCM), Australia's biggest gold producer, sank 6.7 percent as bullion traded near a five-month low. Hyundai Motor Co., South Korea's top carmaker, lost 4.2 percent as November sales fell. Sekisui Chemical Co. surged 7.5 percent in Tokyo on a report it developed a material that triples the capacity of electric-vehicle batteries.

The MSCI Asia Pacific ex-Japan Index dropped 0.5 percent to 472.12 at 9:16 p.m. in Tokyo. The broader regional gauge lost less than 0.1 percent to 141.63 as seven of its 10 industry groups fell. More than $8 trillion has been added to the value of global equities this year, the most since 2009, as central banks took steps to shore up economies worldwide. U.S. stocks slid yesterday as investors weighed the impact stronger manufacturing data will have on Fed bond buying.

"Economic data over the past few weeks have been progressively coming in better and markets are now in the mood to put good economic news as bad news because that will bring forward any reduction in central-bank support," Matthew Sherwood, head of investment markets research at Perpetual Ltd., which manages about $25 billion, said by telephone. "There might be a little bit of downward pressure this month."

Regional GaugesHong Kong's Hang Seng Index retreated 0.5 percent. South Korea's Kospi index dropped 1.1 percent. Australia's S&P/ASX 200 Index lost 0.4 percent, while New Zealand's NZX 50 Index declined 0.2 percent. Taiwan's Taiex index fell 0.3 percent.

Japan's Nikkei 225 Stock Average rose 0.6 percent to its highest level since December 2007, while the Topix index gained 0.3 percent. Shares climbed as the yen fell to a six-month low against the dollar.

The FTSE Bursa Malaysia Index (FBMKLCI) gained 0.3 percent to a record close. Tenaga Nasional Bhd. jumped by the most in 2 1/2 years after the government allowed the electricity producer to raise prices. Singapore's Straits Times Index decreased less than 0.1 percent.

China's Shanghai Composite Index advanced 0.7 percent. The nation's non-manufacturing purchasing managers' index fell to 56 last month from 56.3 in October, according to a report released today by the National Bureau of Statistics and the China Federation of Logistics and Purchasing. A reading above 50 indicates expansion.

Australia retail sales increased 0.5 percent in October from the previous month, beating economists estimates, while the current-account deficit for the third quarter widened more than forecast. The Reserve Bank of Australia kept its benchmark rate at a record-low 2.5 percent today, in line with the consensus view of all 30 economists surveyed by Bloomberg News.

Relative ValueThe Asia-Pacific equity index jumped 9.5 percent this year through yesterday amid signs the global economy is recovering.

Futures (SPA) on the Standard & Poor's 500 Index lost 0.3 percent today. The U.S. equities benchmark index dropped 0.3 percent yesterday amid data that showed manufacturing unexpectedly climbed last month and retail spending fell on the weekend after Thanksgiving for the first time since 2009.

The U.S. Institute for Supply Management's manufacturing index rose to 57.3 in November, a report yesterday showed, after economists surveyed by Bloomberg called for a drop to 55.1. Four of five investors surveyed last month saying they expect Federal Reserve policy makers to put off cuts to their $85 billion-a-month in bond purchases until March 2014 or later.

Gold MinersGold producers dropped after the bullion fell yesterday to the lowest close since June 27 and headed for for its first annual decline in 13 years. Newcrest dropped 6.7 percent to A$7.25. Zijin Mining Group Co., China's largest producer of the precious metal, dropped 1.7 percent to HK$1.76 in Hong Kong.

Hyundai Motor lost 4.2 percent to 239,000 won in Seoul as falling car sales damped the outlook for fourth-quarter earnings. Hyundai unit Kia Motors Corp. dropped 5.2 percent to 56,500 won.

Sekisui Chemical rose 7.5 percent to 1,298 yen in Tokyo. The Nikkei newspaper reported that the company developed a cheaper and longer-lasting material for lithium-ion batteries used in electric vehicles.

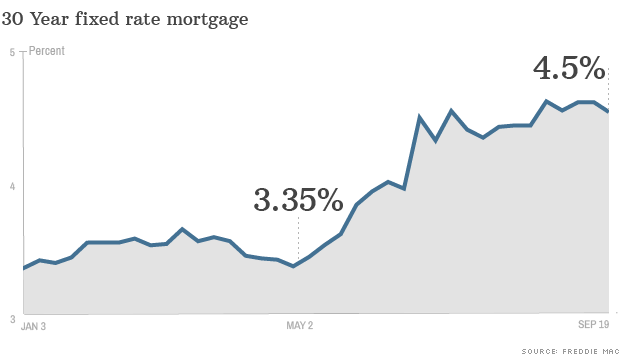

NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

Juergen Teller, Courtesy of the artist

Juergen Teller, Courtesy of the artist

Reuters

Reuters  Enlarge Image Twitter CEO Dick Costolo is interviewed before the Twitter Inc. IPO on the floor of the New York Stock Exchange in New York, Nov. 7.

Enlarge Image Twitter CEO Dick Costolo is interviewed before the Twitter Inc. IPO on the floor of the New York Stock Exchange in New York, Nov. 7.