Few stocks are as levered to the success of the Canadian oil sands as Baytex Energy (BTE). Baytex is a Canadian E&P company. The vast majority of Baytex's production comes from heavy oil, which is also sometimes known as thermal oil. The spread between heavy oil prices and WTI has recently narrowing significantly. I anticipate that Baytex will be reporting much stronger Q2 2013 earnings when compared with Q1 due primarily to improvements in its realized prices for its energy production. Baytex has not had a good 2013, with the stock down 4.5% YTD. However, in the past month it has gained about 13%. Baytex currently offers a $0.22 per share monthly dividend and yields about 6.10%.

(click to enlarge)

Overview

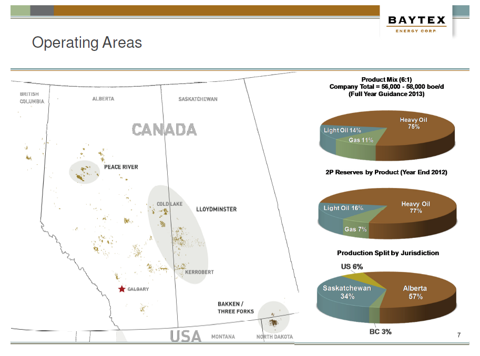

Baytex's assets are mostly located in western Canada, with a smaller chunk near the US border in North Dakota in the Bakken. As mentioned above, Baytex's production is heavily tilted towards heavy oil, representing nearly 75% of production for FY 2013. Baytex's reserves are liquids rich, with natural gas only representing 7% of reserves.

(click to enlarge)

Unlike many of its peers, Baytex has a relatively strong balance sheet. Baytex's debt to EV is a modest 10%. Debt to EBITDA is less than 1.0x while debt to FFO is also a modest 1.4X. Baytex has been by far the most conservative of the ex-Canroys' in its use of it debt. Due to its more restrained dividend policy, Baytex has been able to maintain its dividend level in the face of low realized prices for its energy. In addition, Baytex has not been compelled to do asset sales or other divestitures. Except for the past 2 or 3 quarters, Baytex's FFO has mostly covered its dividends plus maintenance capex.

(click to enlarge)

Q2 2013 Earnings Estimate

As I mentioned earlier, Baytex should see a large increase in earnings due to higher prices for its production. Heavy oil spreads have moderated greatly and WTI remained elevated during the quarter. I will attempting to estimate a few of Baytex's Q2 2013 results. I will estimating Baytex's revenues (both total and per BOE), operating netbacks, and FFO. My analysis will not be factoring in the impact of hedges, but will be using data from Baytex's Q1 2013 earnings, its recent operational update, and its July corporate presentation.

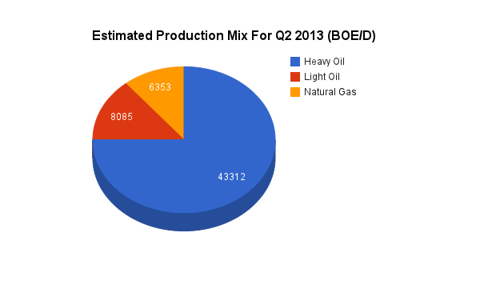

First, let us look at Baytex's production. As shown in the operational update, Baytex estimates Q2 production to range from 57,500 to 58,000 BOE/D. This is a 11% increase from Q1 2013 and a 9% increase from Q2 2012. Baytex's provided FY 2013 guidance for its production mix is 75% heavy oil, 14% light oil, and 11% natural gas. When using both this guidance and the midpoint for the above production range of 57,750 BOE/D, we arrive at 43,312 BOE/D of heavy oil production, 8,085 BOE/D of light oil production, and 6,353 BOE/D of natural gas production.

(click to enlarge)

Now that we have a fairly good grasp of Baytex's production, we now need to figure out its revenues. We will need to estimate Baytex's realized prices for its production of natural gas, light oil, and heavy oil. Once again, do note that I will not be including the impact of hedges in these estimates.

Natural Gas

Due to its Bakken production, it is best to use NYMEX prices instead of AECO prices for natural gas when estimating Baytex's revenues. The NYMEX natural gas settlement prices were $3.97 for April, $4.15 for May, and $4.14 for June. This averages out to about $4.09 per MCF, or $24.52 per BOE. When using! the esti! mated production for natural gas of of 6353 BOE/D, we arrive at revenues of around $14.02M.

Light Oil

Light oil prices for Baytex generally improved in Q2 2013 when compared with Q1 2013. The monthly averages provided by Suncor (SU) for Edmonton Light sweet are usually a good gauge for the direction of western Canadian light oil prices. Using the provided numbers, I estimate that Baytex's realized light oil prices increased about 5% quarter to quarter. In Q1 2013, Baytex's realized price for light oil was about $76.72 per BBL, therefore the estimate for Q2 2013 light oil prices would be $80.55 per BBL. Using the above provided estimated production of 8,085 BOE/D, we arrive at revenues of about $58.62M for light oil.

Heavy Oil

Heavy oil spreads have improved significantly in Q2 2013 when compared with Q1 2013. The discount of Baytex's heavy oil, as measured by WCS, to WTI averaged 34%, or nearly $30 per BBL, in Q1 2013. However, this discount now hovers around $15 per BBL. Since the quarter did have several weeks where the discount was large, I will be splitting the difference and will assume Baytex's saw an average $7.50 per BBL improvement in its heavy oil pricing in Q2 2013. Baytex's average realized price for heavy oil was $53.47 per BBL in Q1. When adding $7.50, this would increase to about $60.97 per BBL. Using the provided estimated production of 43,312 BOE/D, we arrive at estimated revenues for heavy oil of about $237.67M.

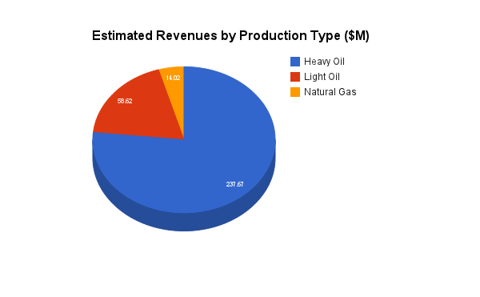

To summarized, I estimate that Baytex revenues will be $237.67M for heavy oil, $58.62M for light oil, and $14.02M for natural gas. This totals about $310.31M, which would be a 25% improvement from the $247.28M of oil and natural gas revenues for Q1 2013. Below is breakdown of my estimates for revenues by production type:

(click to enlarge)

Using the above estimated revenues of $310.31M, we can estimate Bayt! ex's reve! nue per BOE. Using the estimated production of 57,750 BOE/D, we arrive at $59.70 of revenues per BOE, a 17% improvement from Q1 2013 revenue per BOE of $50.94.

When calculating operating netbacks, note that this figure is revenues per BOE minus royalties, transportation and operating expenses. This figure is fairly close to what gross margins would be for a regular, non E&P stock. In Q1 2013, Baytex's operating expenses were $13.95 per BOE, royalties were $9.68 per BOE, while transportation costs were $4.38 per BOE. Assuming similar costs for transportation and operating expenses and a 17% increase in royalties, I estimate that Baytex's operating netback per BOE will be around $30.05, and increase of around 20% from the $24.88 reported in Q1 2013.

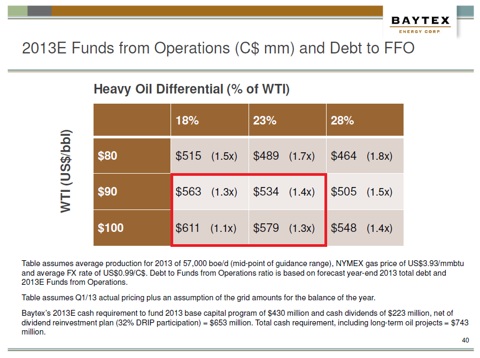

Finally, let us take a look at Baytex's FFO. This figure is very tricky to calculate, however Baytex does provide a useful estimate, which is shown below:

(click to enlarge)

Note that due to the outsized impact of heavy oil, this estimate for FFO is highly reliant on the discount between it and WTI. The red box is the range where heavy oil traded most of the quarter. This gives us a FY 2013 FFO range of around $534M to $611M. Per quarter, this would be $133.4M to $152.75M. The midpoint of this range is around $143M. This would be a massive 40% quarter on quarter increase from the $101.8M in FFO for Q1 2013.

To summarize, I estimate that Baytex's total oil and natural revenues will be around $310.31M, revenues per BOE of around $59.70, operating netbacks of about $30.05, and FFO of around $143M.

| Q2 2013 Estimate | Q1 2013 Actual | Difference | Percentage (+/-) | |

| Revenues | $310.31M | $247.28M | $62.64M | 25% |

| Revenues per BOE | ! $59.70 | $50.94 | $8.76 | 17% |

| Operating Netbacks Per BOE | $30.05 | $24.88 | $5.17 | 20% |

| FFO | $143M | $101.8M | $41.2 | 40% |

****Do note that my estimates do not take into account the impact of hedges. Also note that Baytex's light oil revenues include NGLs sales. Finally, total oil and natural gas revenues do not include revenues from heavy oil blending, which was $25.6M in Q1 2013.

Conclusion

It is easy to see why Baytex has run up over the past few weeks. The company is likely to report much better than expected earnings, thanks to higher prices for energy and higher production. Do note that my estimates may very will vary greatly from actually results as there is a lot of noise in the metrics used.

Baytex is probably the lowest risk of the Western Canadian E&P stocks I follow. Its monthly dividend and low debt have allowed it to trade within a much narrower range than its peers. Its recent price surge is a very bullish signal, and I do not believe it is done going higher.

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I am long PGH

No comments:

Post a Comment