COMPANY OVERVIEW

Coach (COH) is a leading U.S. marketer of premium handbag and accessories. The company sells products globally through both direct and indirect channels; and by building a business model that emphasizes on "accessible luxury", Coach is able to reach a larger demographic than many of its higher-priced competitors. With superior margins and consistent double-digit annual revenue growths, Coach runs a highly profitable business, generates strong cash flows, and has virtually no debt.

Coach offers a number of key differentiating elements that set it apart from the competition, including:

A Distinctive Brand - Coach offers distinctive, easily recognizable, accessible luxury products that are relevant, extremely well made and provide excellent value.

A Market Leadership Position With Growing Share - Coach is America's leading premium handbag and accessories brand and each year, as its market share increases, its leadership position strengthens. In Japan, Coach is the leading imported luxury handbag and accessories brand by units sold.

Loyal and Involved Consumers - Coach consumers have a specific emotional connection with the brand. Part of the Company's everyday mission is to cultivate consumer relationships by strengthening this emotional connection.

Multi-Channel International Distribution - This allows Coach to maintain a critical balance as results do not depend solely on the performance of a single channel or geographic area. The Direct-to-Consumer channel provides us with immediate, controlled access to consumers through Coach-operated stores in North America; Japan; Hong Kong, Macau, and mainland China; Taiwan; Singapore and the Internet. Beginning with the first quarter of fiscal 2013, this channel also includes Coach-operated stores in Malaysia and Korea. The Indirect channel provides COH with access to consumers via wholesale department store and specialty store locations in over 20 countries.

Source: Coach's 2012 10-K Report

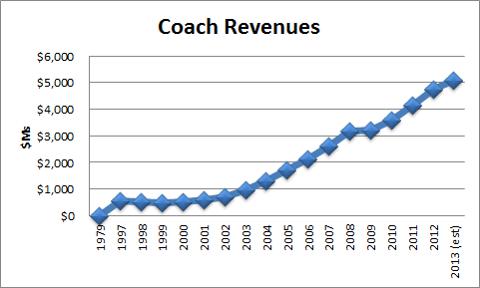

Management: Lew Frankfort is the longtime CEO and Chairman of Coach. He joined Coach in 1979 as Vice President of New Business Development, six years before it was acquired by Sara Lee in 1985. Mr. Frankfort led Coach's transition from a subsidiary of Sara Lee to an independent publicly traded company on the NYSE. He has contributions to the rapid sales growth of Coach (from $6M in 1979 to an estimated $5B in 2013). Mr. Frankfort was recognized by Barron's from 2005 to 2008 as one of its 30 Most Respected CEOs and Institutional Investor voted him as the top CEO in his sector from 2004 to 2009. In 2014, he will hand off the CEO duties to Coach's President & Chief Commercial Officer Victor Luis while remaining Executive Chairman of Coach.

Source: Coach's Profile on Lew Frankfort and FactSet

Victor Luis is the President and Chief Commercial Officer of Coach as well as the CEO-in-waiting. Mr. Luis has been a member of Coach's senior leadership team since 2006 and has served in a variety of key international leadership roles. Most recently, Mr. Luis served as President, International Group, with oversight for all of Coach's operations outside of North America. Prior, he served as President for Coach Retail International, where he oversaw the company's directly operated businesses in China (Hong Kong, Macau and Mainland China), Japan, Singapore, and Taiwan, and President & CEO, Coach China and Coach Japan. Mr. Luis originally joined Coach in June 2006 as President & CEO, Coach Japan, Inc.

Prior to joining Coach, from 2002 to 2006, Mr. Luis was the President and Chief Executive Officer for Baccarat, Inc., running the North American operation of the French luxury brand. Ea! rlier in ! his career, Mr. Luis held marketing and sales positions within the Moët-Hennessy Louis Vuitton (LVMH) Group.

Reed Krakoff is Coach's Executive Creative Director but will be leaving Coach in order to focus on his Reed Krakoff branded products. Coach hired Perella Weinberg in order to explore strategic options for the brand as it is losing money. Coach will most likely sell it to Mr. Krakoff and Perella Weinberg will ensure that the deal is fair and balanced for both parties.

Ownership: The directors and executive officers as a group beneficially held 6.656M ordinary shares, representing approximately 2.31% of the outstanding shares as of June 30, 2012. This figure includes 4.8M shares beneficially owned by Coach's CEO Lew Frankfort and 656K Executive Creative Director Reed Krakoff. Notable institutional investors in Coach as of CQ1 2013 include Artisan Partners (1.56%), Harding Loevner (1.64%). Morgan Stanley Investment Management also purchased 5.8M shares of Coach in H2 2012 and has 4M shares (2%) as of CQ1 2013 after selling off 1.8M shares in the most recent quarter.

SUMMARY OF OBSERVATIONS

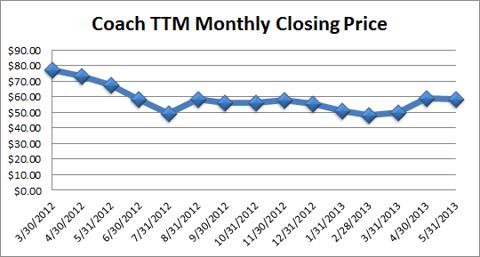

Although Coach's growth has come down in 2013 versus the 2000 to 2012 period, it should be noted that Coach is still expected to generate solid single digit growth. While Coach may have been an overvalued company last year at $80/share, we find it to be undervalued at $58/share. We like the fact that the firm has been able to maintain solid gross margins that exceeded 70% over the last 10 years, which shows that Coach has strong brand recognition and pricing power.

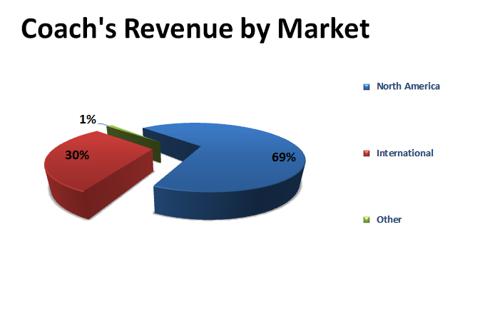

Coach increased its revenue from $953M in 2003 to $5.1B projected for 2013 (CAGR 18.3%) and its EPS from $0.41 to $3.73 (CAGR 24.7%) during the same time period. Coach achieved this primarily through organic growth as well as the 2005 acquisition of the 50% minority interest in Coach Japan from Sumitomo Corporation. Coach recently changed its reportable segments to a geographic focus, recognizing the expansion and growth o! f sales t! hrough its international markets. This is consistent with organizational changes implemented during fiscal 2012.

Prior to this change, the Company was organized and reported its results based on directly-operated and indirect business units. The Company has recently experienced substantial growth in its international business, while at the same time has converted formerly wholesale businesses in several key markets such as China, Taiwan and Korea to Company-operated businesses. Reflecting this growth and corresponding declines in indirect businesses relative to Company-operated, the Company implemented a realignment of its business units based on geography, aligning with the organizational changes.

Source: Coach's 2013 Q3 10-Q Report

Although Coach is one of the most respected companies in the consumer products, luxury brands and accessories industry, it has seen some recent competitive headwinds due to the emergence of Michael Kors (KORS). Coach's management believes that it can achieve growth in line with the expected 5%-10% growth rates that are achieved in the handbag market. Coach is in the midst of implementing a multi-year, transformative set of strategies to endue more emotion into its brand. Coach's management has taken steps to transform the Coach brand into more of a lifestyle brand.

RECENT QUARTER

Coach's most recent fiscal quarterly period enjoyed a stronger growth trajectory than Q1 2013 and Q2 2013. Below are highlights for the quarter ending December 29, 2012:

Net sales totaled $1.19 billion, up 7% from prior year period;EPS totaled $0.84, up 9% from prior year;Gross margin was 72.2%, consistent with prior year;Operating margin declined 96 bps to 35.0%;North America sales increased 0.6% to $1.08 billion; however, comparable store sales saw a 2.2% decline;International sales increased 12% to $411 millio! n, driven! by 40% gain in sales in China, and partially offset by 7% decrease in Japan sales (2% decrease in constant currency).North American revenue rebounded due to the absence of Superstorm Sandy. North American direct sales rose 8% for the quarter with comparable store sales up 1%. At POS, sales in North American department stores were slightly above prior year while shipments into this channel rose slightly as well. Coach still has to deal with the emerging popularity of trendy brands such as Michael Kors and Tory Burch. Coach tried to acquire Tory Burch last year but no deal was consummated. International sales increased 6% to $382 million from $359 million last year. On a constant currency basis sales rose 14% for the quarter.

China results continued very strong, with total sales growing 40% and comparable store sales rising at a double-digit rate. Shipments into international wholesale accounts fell slightly, while underlying POS sales trends remained robust. In Japan, sales were even to prior year on a constant-currency basis, while dollar sales declined 14%, reflecting the weaker yen. Coach reached a deal to purchase its partner's 50% interest in its businesses in the United Kingdom and Europe, with the transaction expected to close in July. Coach bought back $400M of its shares in H1 2013, paused its repurchase program in Q3 2013 and has $1.4B remaining on its share repurchase authorization.

VALUATION and PROJECTIONS

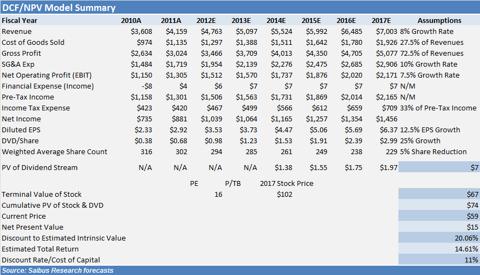

Our $74 per share FV is based on applying a 15 times price to earnings multiple to estimated 2017 earnings per share of $6.37 and discounting the terminal value back to 2013 at a cost of capital of 11%. We believe the PE of 16X reported EPS is justified due to Coach's superior consumer products franchise and strong brand recognition. Also we believe that the multiple used is justified considering that the firm has grown faster than its industry and its price had declined by 25% from its 2012 highs.

We believe that the company will continue to grow its businesses! , particu! larly its handbag products segment. We also see potential in its efforts to relaunch shoes in half of its retail store locations. We like that Coach has declined by 25% versus its 2 year high. We expect that the company will take steps to mitigate the competitive headwinds it is facing thanks to Michael Kors. Coach is a high quality company and its FY 2013 PE Ratio is 19% below the comparable PE of the S&P 500, even though Coach is a higher quality business.

Source: Morningstar Direct

KEYS TO INVESTMENT THESIS

We like the new management change. We applaud Coach CEO Lew Frankfort for his willingness to cede the position of CEO to Victor Luis (Coach's President and Chief Commercial Officer). We have a great deal of admiration for the record of results that Coach has achieved thanks to Lew Frankfort's leadership. We are also pleased that he is willing to step aside in order to promote and develop internal talent within the organization. Coach investors don't have to worry about the company going down the tubes without Lew Frankfort sitting in the CEO's Office since Frankfort will still serve as the Executive Chairman of Coach.

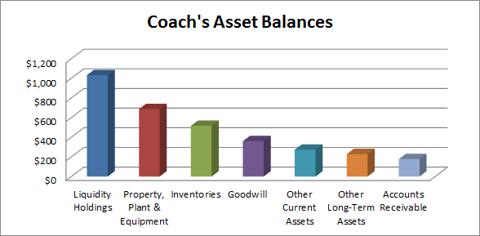

We love that it generates strong free cash flows. Coach has seen its operating cash flows increase from $222M in 2003 to $1.3B over the last twelve months. We like that Coach's business model does not require much in the way of CapEx as CapEx has only increased from $57M in 2003 to $233M over the last twelve months. This also enables Coach to have a liquid balance sheet as its $1B in cash and marketable securities is more than its net Property, Plant & Equipment ($687M). We also like that its liquidity holdings are greater than any of its other asset categories.

Source: Morningstar Dire! ct

! The firm has been able to grow its dividend every year since 2009, while many of its larger competitors were forced to cut or freeze dividends.

We believe the price to earnings ratio is still very low (especially in relation to the market). Coach's adjusted PE based on projected FY 2013 EPS of $3.73 is 16X projected 2013 EPS. This is still less than the S&P 500 (19X projected 2013 EPS) even though Coach has a better business model than the average S&P 500 component.

We love Coach's balance sheet! Coach has only $22.6M worth of debt and $1B worth of cash and marketable securities. Coach's liquidity assets represent 31.5% of its balance sheet assets and it has a conservative capital position ($2.24B in stockholders equity versus $22.6M in debt).

We are optimistic about its estimated future growth projections. Although the company is not growing at the same level it achieved from 2000 to 2012, we are expecting that it will be able to grow its revenues and profits at the same level as the industry and it will be able to meet the competitive challenge that Michael Kors has posed to it.

RISKS TO ACHIEVING FAIR VALUE TARGET PRICE

Failure of investment community to recognize COH's competitive advantages, resulting in a stagnant or declining price/earnings ratio.New stores fail to generate traffic levels that are comparable to existing storesTurnover of key staff, particularly to other firmsProduction quality risks (potential product recalls, regulatory action taken against the firm and shortages of key product inputs)Competitive legal risks stemming from potential intellectual property infringement or if firms try to pirate Coach's products.Failure to develop and commercialize new productsConsumer fashion tastes and other competitors offering the next hot handbagCurrency fluctuations may result in a gain or drag upon conversion to US Dollars.The EuroZone debt crisis providing headwinds to growth, particularly in heavily indebted markets like Greece, Portugal, Spain, Ireland an! d Italy.D! ecelerating growth in emerging marketsAPPAREL, ACCESSORIES & LUXURY GOODS INDUSTRY OUTLOOK

We have a neutral outlook for the industry at large. We believe that the US economy will see economic headwinds due to the expiration of the payroll tax holiday and we expect that political gridlock will serve as a major macroeconomic headwind in the US. We are also concerned that the European economy will continue to flail about due to the sovereign debt crisis and even potential headwinds in the formerly fast-growing emerging market countries

According to international management consulting firm Bain & Co., worldwide sales of personal luxury goods grew an estimated 10% in 2012, to 212 billion euros, led by an estimated 16% increase in the leather goods category. By region, sales rose an estimated 18% in Asia-Pacific, 13% in the Americas, 8% in Japan, and 5% in Europe. Bain projects worldwide luxury goods sales to reach between 240 billion and 250 billion euros by 2015, supported by 4% to 6% annual growth. Bain projects growth to be supported by underlying demand for luxury goods in the U.S., Europe and Japan, and growing luxury demographics in Asia-Pacific, particularly China, and emerging markets.

Apparel brands are increasing their investments in company-owned retail, outlet, and online stores, which provide higher-margin growth opportunities than the highly competitive and promotional department store channel. This strategy enables apparel brands to showcase their entire merchandise assortment, enhance consumer brand awareness, and test new products. Apparel companies are also pursuing growth through development of new product lines specifically for discounters and mass merchandisers, as well as international expansion. Finally, we expect lower cotton prices and supply chain improvements to support gross margin expansion for apparel and accessories brands in 2013. We also look for companies to maintain discipline in inventory and expense management in support of earnings growth. W! e believe! companies with strong brands, differentiated products, and attractive price-value propositions are likely to outperform their peers.

Overall, we feel the industry is fairly valued, however we would use declines in the market to add to positions in high quality firms like Coach and gains in the market to sell weaker firms.

Valuation Analysis 6/10/2013

(click to enlarge)

Disclosure: I am long COH. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: This article was written by an analyst at Saibus Research. Saibus Research has not received compensation directly or indirectly for expressing the recommendation in this article. We have no business relationship with any company whose stock is mentioned in this article. Under no circumstances must this report be considered an offer to buy, sell, subscribe for or trade securities or other instruments.

No comments:

Post a Comment