Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Darden Restaurants (NYSE: DRI ) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

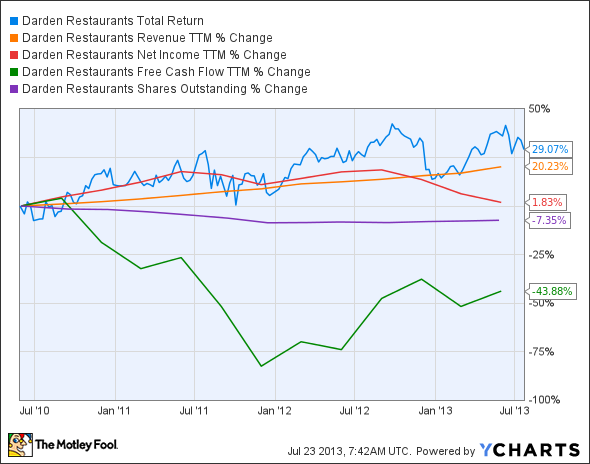

The graphs you're about to see tell Darden's story, and we'll be grading the quality of that story in several ways:

What the numbers tell you

Now, let's take a look at Darden's key statistics:

DRI Total Return Price data by YCharts.

| Revenue growth > 30% | 20.2% | Fail |

| Improving profit margin | (15.3%) | Fail |

| Free cash flow growth > Net income growth | (43.9%) vs. 1.9% | Fail |

| Improving EPS | 10.5% | Pass |

| Stock growth (+ 15%) < EPS growth | 29.1% vs. 10.5% | Fail |

Source: YCharts. * Period begins at end of Q2 (May) 2010.

DRI Return on Equity data by YCharts.

| Improving return on equity | (6.1%) | Fail |

| Declining debt to equity | 49.8% | Fail |

| Dividend growth > 25% | 71.9% | Pass |

| Free cash flow payout ratio < 50% | 97.9% | Fail |

Source: YCharts. * Period begins at end of Q2 (May) 2010.

How we got here and where we're going

Darden serves up an undercooked appetizer for investors here, earning a rather sad two out of nine passing grades. Underwhelming earnings growth and declining free cash flow do not make a good flavor pairing in this dish. Is there any hope left for Darden today?

Darden has been trying to drive sales with menu changes at its two flagship brands, Olive Garden and Red Lobster. Olive Garden's efforts to put more butts in booths revolve around healthier, protein-packed menu additions. Red Lobster has introduced "Seaside Express" at select restaurants, with facilities similar to fast-casual restaurants.

These outlets don't have much notable competition in fast casual, as seafood has been rather underrepresented in a niche dominated by Chipotle (NYSE: CMG ) and other Mexican-themed locales. On the other hand, Red Lobster, despite historically offering a more upscale experience than Chipotle, does not exactly have the same brand cachet with consumers. Full disclosure: I worked my way through college as a Red Lobster server, so my perceptions may be colored by that experience.

Darden will also promote its value offerings with greater promotion across its brands. Olive Garden has reintroduced a buy-one-get-one promotion under the "Dinner Today, Dinner Tonight" tag line, which reinforces and strengthens its entry-level position in the Italian chain hierarchy. In addition to this, a new "Seafood Feast" promotion at Red Lobster will attract more value-conscious customers. A race to the bottom might not be in Darden's best interest -- net income has declined by 10% since the start of 201 and competitor Bloomin Brands (NASDAQ: BLMN ) of the Carrabba's Italian franchise has suffered even more acutely as its net income has plunged nearly 40% in the same time frame. On the other hand, Chipotle's net income is up nearly 40%, so the fast-casual concept could be big, if Red Lobster can make it work.

Management also plans to reduce capital expenditures in fiscal year 2014 by 10%, to $675 million. Location remodeling in the Olive Garden brand will slow, but 15 new locations are still planned for the fiscal year. Darden has huge cash flow potential from its Specialty Restaurant Group, including Yard House, which is expected to push group sales over the $1 billion mark. This segment has plans to add 150-170 restaurants over the next four to five years. However, if the company neglects the appearance of its flagship brands, that may not offset a diner exodus. No one wants to eat Italian in a dump.

Putting the pieces together

Today, Darden has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

No comments:

Post a Comment