Vivus (VVUS) announced Monday that the anti-obesity drug Qsymia is now available at about 8,000 retail pharmacies including, Walgreens, Costco, and Duane Reade pharmacies nationwide. The company had indicated previously that the retail roll-out would take until mid July. Vivus also indicated that it will continue to grow the retail presence over the coming months.

The big question is whether or not this is enough. Vivus management has contended that the lack of retail presence was hindering the business and that the removal of the mail-order only REMS restriction would be a boost to sales. Personally, I see the pharmacy issue as perhaps offering modest improvement at best, but as with anything, time will tell.

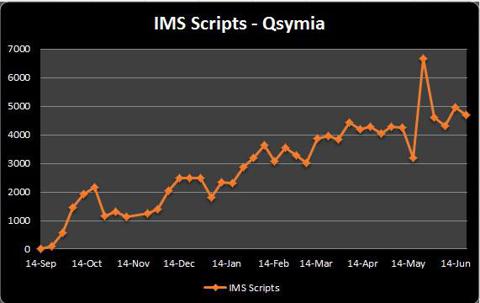

Last week, Vivus saw their IMS Health script total decline from 4,945 the week prior to 4,689, a decline of about 5%. Had the script numbers ramped up this past week, we could have seen the company have a shot at 20,000 for the month. Now the company would need about 6,000 in the final week to garner that number. That is unlikely in my opinion, even with the new retail pharmacy availability.

(click to enlarge)

If the added retail presence makes a difference, we should see weekly script numbers come in above the trend line. In other words, if the impact of retail outlets is a difference maker for Vivus, we should see next week's scripts at a number over 5,000 with the growth and trend pushing toward 6,000 per week by the end of July. In my opinion, that is asking too much from this drug at this point. One big impact challenging sales could be the availability of Belviq, an anti-obesity drug from Arena Pharmaceuticals (ARNA). Belviq was launched on June 7th and had IMS script numbers of 1,829 last week (its second week of data). It took Qsymia 4 weeks to get to 1,939 scripts according to IMS Health.

W! hile adding retail pharmacies is a positive for Vivus, I simply do not see it as something that will double the number of scripts sold in a speedy fashion. Instead, I see it as making it possible to continue a steady growth pace.

In my opinion, the key to success with both Qsymia and Belviq is with the insurance companies. The more companies that offer treatment of these drugs, the better off sales will be, and the more money these companies can put onto the bottom line. Adding 8,000 pharmacies is a step in the right direction, but the impact on the equity will be minimal unless we see weekly script numbers increase toward 6,000 per week in the next few weeks. What will move this equity is getting the ongoing battle with First Manhattan resolved, and additional insurance coverage. Stay Tuned.

Source: Vivus's Qsymia Now Available At 8,000 Pharmacies - Is It Enough?Disclosure: I am long ARNA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I have no position in Vivus.

No comments:

Post a Comment