RECOMMENDATION

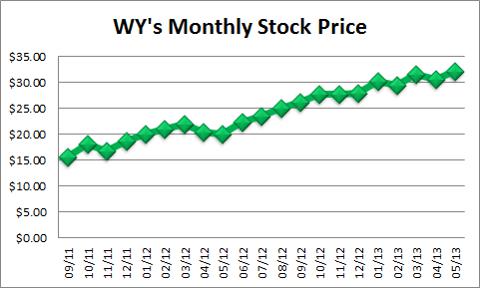

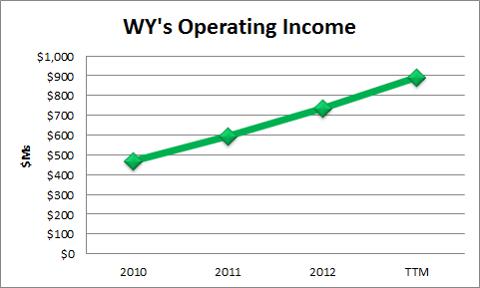

We have an Accumulate rating on Weyerhaeuser's (WY) common stock. We believe that investors have bid Weyerhaeuser's stock up by 75% over the last six quarters because they are counting on a recovery in the housing market to serve as a catalyst for growth in WY's top and bottom lines. We can see that it would provide significant leverage to WY's bottom line because 53% of WY's operating income was used to pay debt interest so any boost to revenue would boost WY's operating income and enable WY to generate significant gains in Net Income. We increased our fair intrinsic value per share for Weyerhaeuser from $29.02 in October to $34.88 in March and we're raising it again to $35.92. Although WY's share price has generated strong growth since 2011, we believe that the company will be able to enjoy steadily improving revenues and operating income, which will boost its pre-tax income and net income due to the financial leverage that it employs.

Source: Morningstar Direct

WY and the majority of the timber, forest and paper products companies have a track record of unimpressive returns on capital, cyclical revenue and profit trends, heavy use of capital expenditures, and significant environmental regulation. We also think that WY's conversion to a REIT was a mistake. Morningstar Investment Research's Timber, Forest and Paper Products analyst Dan Rohr said it best when he rated WY and its Timber REIT peers Rayonier (RYN), Potlatch (PCH) and Plum Creek (PCL) as not possessing any economic moat. That probably explains why we only have an ancillary exposure to this industry for our proprietary portfolio based on our holdings in Brookfield Infrastructure (BIP) and Cintas (CTAS). Brookfield's Timber segment only accounts for 5% of its Fund Flows from operations and Cintas's document management business is suffering from redu! ced prices on recycled paper. At least Cintas Document Management only accounts for 8% of Cintas's revenue.

We think that WY's REIT conversion was a mistake because it still has to pay federal corporate income taxes on earnings on its manufacturing businesses, its real estate development business, built in gains on sales of real property held by the REIT and the portion of its Timberlands business included in its taxable REIT subsidiaries. Despite its tax-exempt REIT operations and despite its tax-advantaged foreign source operations, the company still paid an average effective adjusted recurring corporate tax rate of 17% in 2012. Plus, the only way that it can maintain its tax-exempt status for its tax-exempt REIT operations is by distributing 90% of its pro forma taxable income to shareholders as dividends.

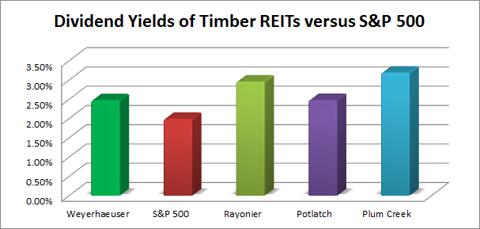

We think that capital intensive companies shouldn't be distributing 90% of its pro forma taxable income to shareholders because such companies need the cash to fund capital investment expenditures. Even though WY is a REIT, its dividend yields on these companies are not significantly higher than that of the S&P 500 index as represented by the SPDR S&P 500 ETF. WY's yield also trails its Timber REIT peers (RYN, PCH and PCL) however it recently increased its annualized per share dividend by $.08 (13.3%) in Q4 2012 and recently raised it by an additional $.12. We believe that the run-up in share price by WY and its peers has been influenced by the relatively higher dividend yields in relation to the low yields achieved on fixed income securities as well as Helicopter Ben's Manic Money Printing Program.

Source: Morningstar Direct

COMPANY OVERVIEW

Weyerhaeuser is the largest forest products real estate investment trust in the United States. Weyerhaeuser grows and harvests trees, builds homes and makes a range of forest products essential to everyday lives. The co! mpany has! undergone a dramatic level of strategic and organizational level change over the past several years in the wake of its debt-funded hostile takeover of Willamette Industries in 2002. In 2006, Weyerhaeuser agreed to spin off its fine paper business under a split-off transaction with Domtar Inc (UFS). Under the terms of the deal, Weyerhaeuser would spin-off the fine paper business and the business would merge with Domtar Inc to create Domtar Corporation. Weyerhaeuser has four business segments as follows:

Timberlands: WY's Timberlands business segment manages 6.3 million acres of private commercial forestland worldwide. WY owns 5.6 million of those acres and leases the other 0.7 million acres. In addition, WY has renewable, long-term licenses on 13.9 million acres of forestland located in four Canadian provinces.Wood Products: WY's Wood Products segment provides lumber, structural panels and other specialty products to residential, multi-family and commercial real estate markets. It also delivers innovative homebuilding solutions to its customers, sells products and services for the home-improvement market and exports its products to Asia and EuropeCellulose Fibers: WY's Cellulose Fibers segment is one of the world's largest producers of absorbent fluff in diapers. It also developed specialized fiber applications for its customers, manufactures liquid packaging board and other pulp products and generates energy from biomass and black liquor produced at the mills.Real Estate: Weyerhaeuser Real Estate Company and its subsidiaries focus on constructing single-family housing and developing residential lots for WRECO's use and for sale to external customers.

Source: WY's Q4 2012 Earnings Report

Management: Daniel Fulton has been CEO and a member of WY's board since 2008. He has over 37 years of experience in the industry with Weyerhaeuser and before! serving ! as CEO of WY, he had 14 years of executive leadership experience with Weyerhaeuser's real estate division, serving as its CEO, President, COO and CIO. We're not happy that WY's CFO Patricia Bedient is an alumnus of Arthur Anderson even though she had nothing to do with the Enron debacle that forced Arthur Anderson to go bankrupt. Overall, we had a neutral opinion of WY's management but we are increasing our assessment as the company's turnaround progresses.

Ownership: We like that one director (John Kieckhefer) owns 8M shares of the company. This represents 1.5% of the company's stock and includes 7M owned by Kieckhefer Associates on behalf of that firm's clients. The Non-Executive Chairman Charles Williamson does not own any shares of WY and but owns 109K in restricted stock units and common stock equivalent units as part of the director fee deferral plan. The majority of shares are owned by large bulge-bracket asset management institutions on behalf of client accounts however the only two notable institutions that own shares include the Morningstar Five Star Rated First Eagle Global Mutual Fund (SGENX) (which was managed by legendary value investor Jean-Marie Eveillard who still serves as an advisor) and Third Avenue Management LLC, which was founded by legendary value investor Marty Whitman. With regards to WY's bonds, the largest bondholder for WY is PIMCO, which holds at least $352M face value of WY's bonds in five of its mutual funds.

SUMMARY OF OBSERVATIONS

Although Weyerhaeuser's operating margins have bounced back since its 2010 lows, WY is still in a commodity business that has a volatile revenue and profit trend, requires significant capital expenditures and has no significant economic moat. Since its 2002 debt funded hostile takeover of Willamette Industries, WY has significantly slimmed down its organization in order to qualify for Real Estate Investment Trust tax treatment. In 2007, it completed the divestiture of its fine paper business to Domtar as part of a $3.3B cash ! and stock! split-off transaction. In 2008, it sold its Containerboard and Recycling business to International Paper for $6B in cash. In 2009, it completed the sale of its Trus Joist commercial division to Atlas Holdings. This was of interest to us because WY had acquired Trus Joist only 10 years before.

Source: Morningstar Direct

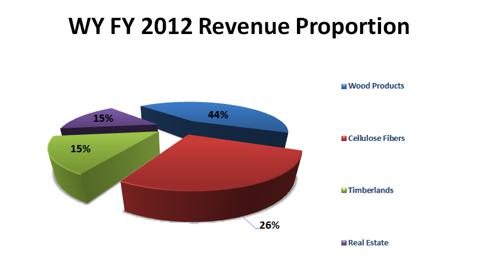

In 2010, it was able to successfully execute its conversion into a REIT, joining fellow timber firms Potlatch, Plum Creek and Rayonier. Weyerhauser generated $7.06B in revenue in FY 2012 and this was more than its three timber competitors combined. However, WY had a significantly lower profit margin than its timber competitors due to the fact that its wood products operations accounts for 44% of its revenue and it has operating margins below 5% in YTD 2012. Another reason why the company has low profit margins is because its interest expense accounts for over 53% of its FY 2012 operating income versus 33% at Potlatch, 12.2% at Rayonier and 50% at Plum Creek.

Source: Morningstar Direct

Weyerhaeuser generated $389M in free cash flows in FY 2012 versus $413M in FY 2011. However, we were pleased to see that the company's FY 2012 free cash flows were less reliant on one-time asset sales ($93M) versus 2011 ($362M). The company had a 100% increase in its operating cash flows and this was offset by increased CapEx of $44M as well as the reduced level of asset sales. That represented a free cash flow return on beginning period equity of 9%. Although we prefer businesses that are generating double digit cash flow ROEs without the aid of asset sales, we believe that WY is making the necessary steps to maintain and potentially improve ROEs and ROICs.

Weyerhaeuser had $4.5B in debt as of Q1 2012 ($4.1B as of Q1 2013)! and incu! rred $348M in pre-tax interest expenses. Weyerhaeuser's pre-tax return on beginning period capital was 8.4% in FY2012, which is lower than what we would prefer and we recognize that the company has to pay out the interest expense to bondholders. WY's TTM cash flow ROIC adjusted for working capital showed signed of improvement due to the stronger industry environment. One area of interest to us with WY is its financial reporting. We find that due to the nature of WY's operations, we would need detailed financial reporting of its four business divisions and WY does not disappoint us here.

VALUATION AND PROJECTIONS

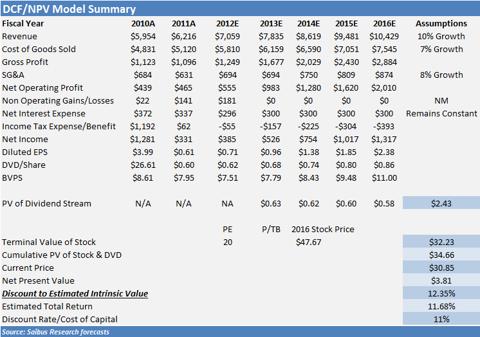

We have revised our intrinsic fair value per share for Weyerhaeuser from $29.02/share in October to $34.88 in March to $35.92. We revised our estimate upward because the company increased its per share dividend by 33% since September 2012 and we expect that the company will increase its annualized dividend by $.08 each year until 2016. We have also increased our estimates based on more favorable revenue and expense projections for forward periods. The company's share price of $32 represents a 13.6% discount to our fair intrinsic value. We discounted WY's cash flows and terminal period share price at 11%, which is our firm's minimum cost of capital for equity investment opportunities. We expect the companies we invest in to generate an 11% cost of capital (which is the ROE established by our state regulator for utilities).

We believe that regardless of whatever a company's cost of equity or firm wide capital is calculated on Bloomberg LP, we believe that a company's cost of capital should equal or exceed the 11% ROE of a reliable regulated utility. WY's ROE for 2012 was 8% which displeases us because we see higher risk associated with a competitive timber products company than a reliable regulated utility. While we are expecting its EPS to increase from $.61 in 2011 to $2.51 in 2016, we believe that much of the expected growth in EPS and operating margins is priced into the shar! es. WY's ! PE based on our expected 2013 EPS is 25X and we are expecting it to steadily drift down to 20X our expected 2016 EPS.

We are expecting WY's EPS to increase on the strength of an estimated 11.5% increase in revenues from 2012 to 2016 and positive operating leverage resulting in its cost of goods sold and operating expenses only increasing by 8% during this time period. We are expecting the company's interest expense to remain constant during this period as we see that WY only has $254M of debt maturing from 2013-2014 and we expect that the company will refinance this debt at a rate similar to the 7% weighted average it is paying on these debt tranches.

We would encourage the occasionally opportunistic debt retirement so as to steadily improve the company's credit rating. We are expecting the company's effective average tax rate to be 22% based on WY's average effective tax rate in Q4 2012 and we expect this tax rate to remain constant for our observation period. WY's price to book value as of Q1 2013 is 4X and we believe that although WY has assets that are durable and value, it utilizes an ample share of leverage and the majority of its operating income is consumed to pay interest expenses.

RECENT QUARTER (Q1 2013)

Total revenues increased by 30.5% year-over-year, which was beyond our expectations and came on the heels of 23.8% revenue growth achieved in Q4 2012. This above average level of growth was due to strength in its Timberlands business, sharply improved conditions in its Wood Products business and solid performance in its Real Estate business. This helped offset continued weakness in its Cellulose Fibers business. The company benefitted from a 777bp increase in the firm's gross margin and we were pleased that its operating expenses only increased by 6.5% in Q1 2013 versus Q1 2012 and enabled the firm to generate a 153% increase in operating income for the period. We are more than aware that Weyerhaeuser utilizes a high level of operating and financial leverage in its bus! iness and! changes in revenues can have a disproportionate impact on its gross margin and operating income.

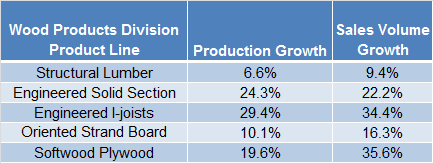

Wood Products saw its revenues increase by 55.8% in the period due to increased sales of its various wood product lines. The division benefitted from Oriented Strand Board prices increasing by $162/thousand square feet (82%) and by lumber prices increasing $129/thousand board feet (41.5%). Sales volumes for engineered solid section wood products increased 19.3%. Q1 2013 sales volumes for lumber increased by 22.2% and lumber production volumes increased by 6.6% versus Q1 2012 levels. All of WY's Wood Products production volumes enjoyed ample year-over-year production growth for the second straight quarter.

Source: WY's Q1 2013 Earnings Report

Real Estate saw its revenues increase by 43.1% in the period. While land and lot sales are a normal objective of WY's land development business, such sales do not occur evenly each period. In Q1 2013, single-family home sold increased 17.65% to 820 homes from 697 homes in Q1 2012. The average home closing price of $394,000 in Q1 2013 was 4.8% higher than Q1 2012 and 3.4% greater than Q4 2012. Gross margins in Q1 2013 were 18.4%, up from 17.5% in Q1 2012. The backlog at the end of the quarter was 1,131 homes, up from 777 in Q1 2012 and up from 774 in Q4 2012. Single family home closings increased by 32.1% in Q1 2013 versus Q1 2012.

Timberlands saw its revenues increased by 17.5% in the period due to a $58M increase in revenues from the sale of logs. The company saw 18.65% increases in sales volume demand for its logs and higher prices realized on the sale of its logs. The division was able to keep its cost of goods sold in check as COGS increased by only 11.9% year-over-year and the division benefitted from positive operating leverage as its operating expenses only increased by $5M year-over-year. This enabled segment earnings to increase by near! ly 50% ye! ar-over-year.

Cellulose Fibers saw flat revenues growth in Q1 2013 versus Q1 2012 due to the soft market for pulp prices but at least Q1 2013 revenue was flat relative to Q1 2012-Q4 2012. This resulted in segment earnings dropping from $48M in Q1 2012 to $31M in Q4 2012. On a linked quarter basis, Q2 2012 segment earnings bottomed out at $36M and increased to $78M in Q3 2012 thanks in part to a 50% reduction in scheduled maintenance outages but eased back to $61M even though scheduled maintenance outages were lower in Q4 2012 and slid back to $31M in Q1 2013.

The Cellulose Fibers segment's scheduled maintenance costs increased to $62 million from $45 million, and the number of annual outage days doubled to 12. In addition to annually schedule maintenance outages, there were projects to lengthen the mill maintenance cycle from 12 to 18 months. Fiber costs increased due to wet weather in the South. Average pulp price realizations declined slightly. Pulp sales volumes increased 2%. Production decreased due to the scheduled maintenance outages.

KEYS TO INVESTMENT THESIS

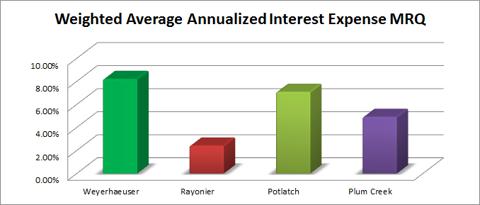

WY has a high cost of funding but offers potential to refinance debt. Interest bearing debt represents 49.35% of permanent capital and at $4.1B has at least decreased from the $13.6B in outstanding debt as of FY2002. Despite the fact that it utilizes a lower leverage ratio than Potlatch and Plum Creek, it has a higher cost of debt than its peers. At least it has been able to match its mix of capital intensive, long duration assets with long duration liabilities and only has $184M in debt to refinance next year.

Source: Morningstar Direct

We believe that the WY's shares have benefitted from the housing recovery. WY's shares have increased by over 100% since last September. The company is trading at over 25X our estimated EPS for 2013 and ~4X its book value. That's pretty rich for a cyclical company with! low retu! rns on equity and invested capital. Also, we already established that WY's dividend yield is lower than its Timber REIT peers. We maintain that investors who want to establish a long position in WY's shares should wait for a 5% pullback before entering into a position.

WY has a significant fixed cost base and that cuts both ways. Sales declines end up resulting in sharp profit declines and sales growth results in sharp boosts to net income. We believe that the potential volatility in its operating and net income explains why the company's shares have a high beta relative to the market.

WY's revenues and profits are heavily dependent on the housing market. With the sale of the company's paper and packaging business, we see that the only business line of WY that isn't directly or indirectly correlated to the housing market is its cellulose fibers unit and this unit accounts for 24% of WY's Q1 2013 revenues.

We saw overcapacity in the wood products industry however it is starting to ease. In our reports on Brookfield Infrastructure, we have seen near-term weakness in the timber industry based on the performance of BIP's timber operations. WY has suffered from the overcapacity in the wood products industry because of weakness in the housing markets and this explains why it incurred five straight years of losses from 2007-2011 before rebounding to a $120M operating profit in 2012. We have seen WY respond to this industry weakness by selling off assets and rationalizing its remaining operations in order to mitigate losses. WY's Wood Products division enjoyed strong revenue and profit growth in Q1 2013

REIT Conversion Has Not Eliminated Taxes: Despite the fact that Weyerhaeuser is a REIT for tax purposes, it has not been a cost free effort to reach this tax status. The company had to dramatically scale down by selling off a number of its subsidiaries and the primary source of free cash flows from its remaining businesses have been the sale of assets and business operations. Even with th! e sale of! assets and operations, WY's free cash flow ROEs have been in the single digits. As for WY's REIT status and taxes, despite the fact that WY has lightly taxed foreign source subsidiaries and despite the fact that WY is a REIT, its taxable subsidiaries have resulted in a 17% adjusted effective tax rate for WY in FY 2012 and 22% in Q1 2013.

FACTORS THAT WOULD HELP WY REACH ITS FAIR VALUE TARGET PRICE

The housing market finally makes demonstrated and sustainable progress which would result in higher sales volumes of its productsThe US avoids an economic recession due to the potential negative impact of the "Fiscal Cliff" and the effects of the "Affordable Care Act"Rationalization of lumber production throughout the industry serving as a catalyst to stabilize and increase pricesThe demand for paper stabilizes, which serves to stabilize paper prices and results in stable and increased demand for its timber products and cellulose fibersWY is able to continue realizing operating leverage which results in the bottom line sprouting upwardConsolidation in the industry serving to reduce competitionGlobal trade and tariff regimes remaining stableThe demand for REITs and other dividend paying investments remains constant in the investment communityThe regulatory climate for logging remains stable or sees a reduction in regulationsThe ability of WY to ensure management stability and transitions. WY's previous CEO Steven Rogel retired at age 65 in 2008 and WY's current CEO Dan Fulton is 63. We expect to see potential leadership transitions during the period.The inverse of these factors will serve as potential risks to the company which could reduce the profitability of the company and would be a negative to the company's stock price

TIMBER, PAPER AND FOREST PRODUCTS OUTLOOK

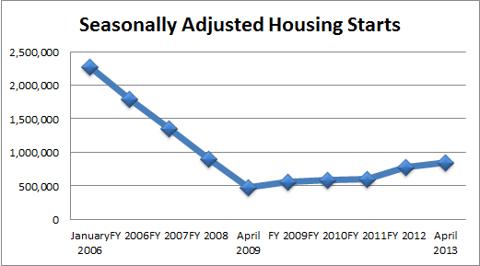

We can see why investors are eyeing the Timber and Forest Products industry as a play on potential housing growth in the US. Nearly half of lumber output in the US is used in the construction of new resident housing units an! d another! 30% is used in the home repair and remodeling market. The housing industry was a major growth driver for the US economy overall and especially for the Timber and Forest Products industry up until the beginning of 2006. Seasonally Adjusted Housing Starts peaked at 2.27M units in January 2006 and collapsed to a 50 year low of 477K units in April 2009. Housing starts have improved from these lows but have a long way to go before returning to 2006 levels. Housing starts improved to 586.9K units in 2010, 608.8K in 2011, 781K in 2012 and 853K in April.

Source: U.S. Department of Commerce New Residential Construction

While Housing Starts have made a respectable bounce off its all-time lows in 2009, the key driver will always be the sales trend for existing homes. The National Association of Realtors reported that seasonally adjusted existing home sales were 4.97M in April 2013, up from 4.59M in May 2012 and 4.13M in May 2011. Total housing inventorycontinues to decline (25.3% over the last 12 months) and is at a 13 year low. We expect residential construction activity to show continued recovery in 2013 on the back of higher housing starts. We see stronger operating margins for the homebuilders and the forest and timber products companies as volume recovers.

The price for lumber and lumber panels has risen and fallen with the performance of the housing market. According to the lumber industry trade publication Random Lengths, a composite lumber price index compiled by that publication reached a high of $473 per thousand board feet in 2004 only to plummet to $193 in 2009 and match the prices last seen in 1991. Lumber prices recovered to $367 in April 2010 on housing market recovery hopes but declined to $242 in August 2010 then increased to $257 in November 2011, $370 in December 2012 and $437 in April 2013.

Consolidation has been inc! remental ! in the paper and forest products industry. In May 2012, Resolute Forest Products ((RFP) formerly AbitibiBowater) announced that it had acquired 50.1% of Fibrek and acquired the remaining 49.9% in August. 2011 saw International Paper (IP) announce a hostile takeover of Temple-Inland and after offering $32/share in cash as well as the assumption of $600M of TIN's debt, IP was able to close the deal in February 2012. 2011 also saw Rock-Tenn (RKT) acquire Smurfit-Stone to create the number two player in the linerboard segment with 20% market share, trailing only International Paper's 40%. We see these moves as a prudent step to consolidation in the industry as certain types of paper such as newsprint and uncoated free sheet (office paper) are seeing falling demand due to increased use of digital resources.

Consolidation in the industry is leading to market share concentration at the top. The acquisition of Temple-Inland by IP has resulted in the top four containerboard packaging producers having 73% of the market, up from 57% before the February 2012 acquisition. As of year-end 2010, the most concentrated sector was coated recycled board, where the top four producers had an 87% share, while they had 72% and 69% shares, respectively, in the uncoated free sheet sector and the tissue market. However, according to Pulp & Paper Week, the containerboard industry, with a capacity of about 38 million tons per year, is much larger than these other categories, with uncoated free sheet the next largest at about 12 million tons per year.

The moves by these companies to concentrate on a few major businesses show us that companies are looking for relatively narrow segments of the market where they can attain high market shares and generate returns that are at least equal to firm wide cost of capital. We think that these moves, in general, are positive for the long-term health of the industry. This more focused approach is likely to lead to better economies of scale and higher overall profitability. We rem! ember tha! t IP had volatile, erratic and weak profitability from 1988-2009 despite a recognized company brand name and recognized product brands like Hammermill.

Overall, we see the industry as fairly valued and its risk adjusted return would be in line with what we expect for the overall S&P 500. We believe that if the housing market shows strong growth, the sector will significantly outperform the market at large due to the high betas associated with Timber REIT Weyerhaeuser and paper products giant International Paper.

Valuation Analysis 5/24/2013

(click to enlarge)

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: This article was written by an analyst at Saibus Research. Saibus Research has not received compensation directly or indirectly for expressing the recommendation in this article. We have no business relationship with any company whose stock is mentioned in this article. Under no circumstances must this report be considered an offer to buy, sell, subscribe for or trade securities or other instruments.

No comments:

Post a Comment