How would you react as a shareholder if the management of a company you owned behaved erratically and consequently pushed down the company's share price? What if after pushing down the share price, management offered to buy you out on the cheap? That is exactly what the Chariman, CEO and 40% owner of Dole (DOLE) David Murdock appears to have done.

In a prior article, I pointed out that DOLE's business fundamentals are improving and that recent divestitures have allowed the company to reduce debt to reasonable levels. In the same article, however, I also argue that management's capital allocation policy and commitment to stewardship were questionable, given the announcement and subsequent retraction of a $200M buyback in a mere twenty days' time. Management also piled on the bad news when announcing the end of the buyback plan by projecting poor operating results from Dole's strawberry segment, causing the stock to crater by more than 15%. I cautioned potential investors that while the business was probably headed for an upswing, the company's questionable leadership (among other things) made an investment too risky.

Buyout Announcement

Today, Mr. Murdock offered $12 per share for the 60% of shares he does not own. Here's an excerpt from his letter to the Board of Directors in which he tries to explain why the stock had fallen 21% since last September since the Dole Asia divestiture deal:

I believe the stock's performance is impacted by a variety of factors, including the fact that the Company deals in perishable commodities which are subject to external factors that result in unpredictable quarterly earnings. It is unlikely that the forces affecting the perishable commodities business will change in the foreseeable future. Further, growing the Company for the long-term will require significant investment, some of which will not generate near-term returns. Therefore, after much consideration, I believe that providing a premium to existing shareholders and operating Dol! e Food Company as a private enterprise is the best alternative given the public-market focus on short-term earnings and predictable quarterly results. This will give the Company greater flexibility to make investment and operating decisions based on long-term strategic goals without the concern that a public company must have for the investing public's short-term expectations. It can also provide opportunities for cost and tax savings. (emphasis added)

I'd argue that informed investors in DOLE know that the company has erratic earnings and that it was the unpredictability of management rather than operating performance that led to selling pressure.

What Now?

In one sense, I was terribly wrong in my previous article when I told investors to stay away. The $12 per share offer represents a 26.7% increase from when I wrote the article seven days ago. So kudos to those posting skeptical comments on my previous DOLE article and other short-term longs, it would have been better in this case to totally ignore my investment advice.

But in a bigger sense, I was right to be suspicious that management made decisions that were not in shareholder's best interests. The market agrees with me that something fishy is going on, pushing the stock up to a premium above the deal price:

DOLE data by YCharts

At a price of $12.40, the market is clearly pricing in the possibility that investors will receive a better deal than the initial $12 offer. Although I cannot make a judgment regarding the likelihood of the deal going through in its current form, a few extrapolations from the current price are illuminating:

If there is a 50% chance of the deal going through in its current form and a 50% chance of realizing a premium, the market is pricing that premium at $0.80 cents per share, or $77M. If there is an 80% chance of the deal going through, the market! is prici! ng that premium at $2.00 per share, or $175M, a very significant figure for a company with a current market cap just north of $1B. If I had to handicap the chance of the deal going through, I'd put it closer to the 80% mark, given that Morningstar lists only three of the seven board members as independent and the board's recent waffling on the share buyback plan.

Deja Vu All Over Again

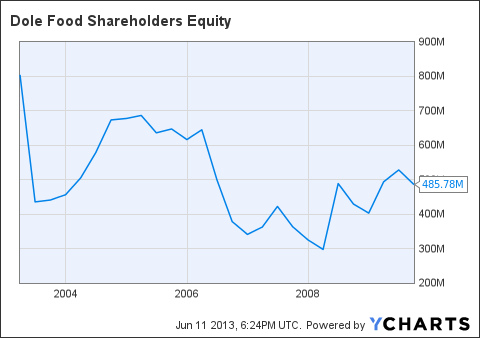

The most frustrating thing about this story is that we've seen it before. In March 2003, Mr. Murdock took the company private. In October 2009, the company completed an IPO, returning the company to the public markets. Had management added any value to Dole during its time as a private company? Nope:

DOLE Shareholders Equity data by YCharts

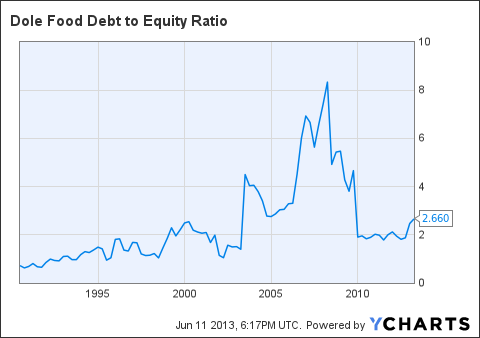

Instead, management leveraged the company to the hilt, nearly running the company into the ground:

DOLE Debt to Equity Ratio data by YCharts

I cannot speak to the operational details of the company while it was private, but if I wanted to strip a company of its valuable parts and sell the rest to an unsuspecting public I'd use a similar strategy that switches debt for equity while pocketing the good assets.

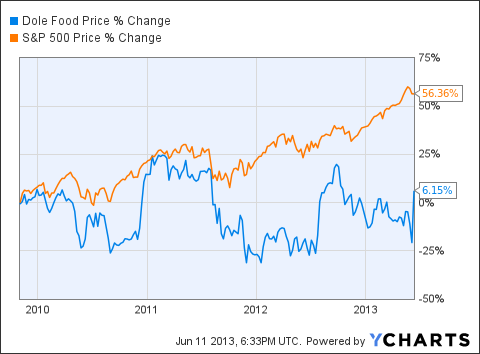

So how has that unsuspecting public done since that IPO? Not well:

DOLE data by YCharts

It took the buyout deal announcement for those initial IPO buyers to be in the black. But now that the company's debt is manageable and business is improving, Mr. Murdock wants the company back. I am no expert in merger arbitrage or estimating the likelihood that certain deals will or will not proceed, ! so I cann! ot offer advice to investors on that front in Dole's case. But I can point out that this story underscores the value of good managers that act as prudent stewards of shareholder capital, and that companies with good management rightly deserve a premium valuation, all else equal.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment