BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Short-Squeeze Stocks Ready to Pop

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>5 Blue-Chip Stocks to Trade Gains

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

Hilton Worldwide Holdings

Nearest Resistance: $23.50

Nearest Support: $22

Catalyst: Secondary Offering

Shares of $22 billion hotel chain Hilton Worldwide Holdings (HLT) are up 1.76% this afternoon on big volume, following the pricing of the firm's 90 million share secondary offering at $22.50. That price tag on the offering, which is expected to close on Friday, is a good indication that HLT still has ample demand for shares at attractive prices.

From a technical standpoint, the HLT is currently forming an ascending triangle pattern, a price setup that's formed by horizontal resistance above shares (at $23.50 resistance) and uptrending support to the downside. A breakout above that $23.50 price ceiling is the next high-probability buy signal for this large-cap hotelier.

Valero Energy

Nearest Resistance: $53

Nearest Support: $40

Catalyst: Lifted Oil Export Ban

Valero Energy (VLO) is down more than 8% on big volume this afternoon -- along with a slew of other domestic refiners -- thanks to a U.S. Commerce Department rule change that allows more U.S. oil exports. A handful of research firms are sending negative notes on refiners this afternoon, turning bearish on refiners now that more lightly refined oil will be eligible for export from shale formations. International buying competition means lower margins for domestic refiners, a painful change after some of the big investments in refining facilities that were made specifically for increased shale supply.

For Valero, the technical picture just turned ugly today. While shares had been bouncing their way higher in a well-defined uptrend, this morning's gap lower is officially breaking the trend line support level that's been a floor for shares since February. With support broken, VLO is a sell now.

CVR Refining

Nearest Resistance: $26.50

Nearest Support: $22

Catalyst: Lifted Oil Export Ban

Mid-cap refining stock CVR Refining (CVRR) is another oil refiner that's getting sold off close to 9% this afternoon in the wake of the Commerce Department's oil new export interpretation.

The price action in CVRR is particularly rough because this name has looked so technically attractive for the last two months. Shares were forming an ascending triangle setup since the start of May, but that pattern broke to the downside this morning. That means that there's a lot more downside risk ahead for CVRR, versus pretty tepid upside – it's a sell.

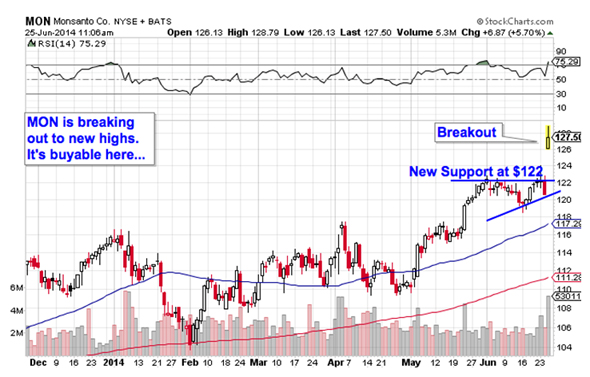

Monsanto

Nearest Resistance: N/A

Nearest Support: $122

Catalyst: Q3 Earnings

Monsanto (MON) is pushing to new highs this afternoon, following the firm's third-quarter earnings release. Monsanto earned $1.62 for the quarter, beating expectations of $1.55. The firm guided earnings higher for the full year as well, up to between $5 and $5.20. Those new highs are driving a technical buy signal this afternoon for traders willing to take on a little extra risk.

New highs are significant from an investor psychology standpoint because they mean that everyone who has bought shares in the last year is sitting on gains. As a result, the "back to even" mentality is less of a concern than it would be for a name with a higher proportion of shareholders sitting on losses.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>Buy These 5 Rocket Stocks to Beat the Market

>>4 Stocks Rising on Unusual Volume

>>5 Stocks Under $10 Poised to Pop in June

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment