DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for under $10 a share don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

Read More: 5 Large-Cap Stocks to Trade for Earnings Season Gains

Just take a look at some of the big movers in the under-$10 complex from Thursday, including Point.360 (PTSX), which is soaring higher by 18%; 8x8 (EGHT), which is ripping to the upside by 12.6%; Amicus Therapeutics (FOLD), which is trending up by 9%; and India Globalization Capital (IGC), which is jumping higher by 8%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

Read More: 5 Stocks Insiders Love Right Now

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

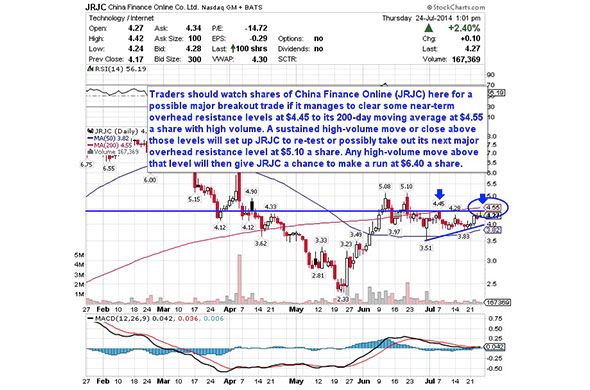

China Finance Online

One under-$10 technology player that's starting to trend within range of triggering a big breakout trade is China Finance Online (JRJC), which provides integrated financial information and services in the People's Republic of China and Hong Kong. This stock has been hit hard by the bears so far in 2014, with shares off sharply by 32%.

If you take a glance at the chart for China Finance Online, you'll see that this stock has started to flirt with a big breakout trade today, since shares have challenged some near-term overhead resistance at $4.28 a share. That action is starting to push shares of JRJC within range of triggering a much bigger breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in JRJC if it manages to break out above some near-term overhead resistance levels at $4.45 to its 200-day moving average at $4.55 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 476,848 shares. If that breakout triggers soon, then JRJC will set up to re-test or possibly take out its next major overhead resistance level at $5.10 a share. Any high-volume move above that level will then give JRJC a chance to make a run at $6.40 a share.

Read More: 3 Huge Tech Stocks on Traders' Radars

Traders can look to buy JRJC off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $3.82 a share. One can also buy JRJC off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Quantum Fuel Systems Technologies Worldwide

An under-$10 alternative energy player that's starting to move within range of triggering a near-term breakout trade is Quantum Fuel Systems Technologies (QTWW), develops, produces and sells natural gas fuel storage systems and integrates vehicle system technologies in the U.S., Germany, Canada, India, Spain and Taiwan. This stock has been destroyed by the bears so far in 2014, with shares off sharply by 30%.

If you take a look at the chart for Quantum Fuel Systems Technologies Worldwide, you'll notice that this stock has been basing and consolidating right above its 50-day moving average of $4.82 a share. Shares of QTWW are now starting to bounce a bit higher right above some near-term support levels at $5 to its 50-day at $4.82 a share. That bounce is beginning to push shares of QTWW within range of triggering a near-term breakout trade a key downtrend line.

Market players should now look for long-biased trades is QTWW if it manages to break out above some near-term overhead resistance levels at $5.50 to $5.73 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 1.27 million shares. If that breakout gets underway soon, then QTWW will set up to re-test or possibly take out its next major overhead resistance levels at $6.13 to its 200-day moving average of $6.69 a share. Any high-volume move above those levels will then give QTWW a chance to tag $7 to $7.50 a share.

Read More: 5 Stocks Set to Soar on Bullish Earnings

Traders can look to buy QTWW off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $4.82 a share. One can also buy QTWW off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

J.C. Penney

Another under-$10 stock that's starting to move within range of triggering a major breakout trade is J.C. Penney (JCP), which sells merchandise through department stores in the U.S. This stock has been red hot over the last six months, with shares soaring higher by 33%.

If you take a glance at the chart for J.C. Penney, you'll notice that this stock has formed a major bottoming chart pattern over the last three months, with shares finding buying interest each time it has dipped below $8 a share. Shares of JCP are now starting to spike higher here right off its 50-day moving average of $8.81 a share. That spike is starting to push shares of JCP within range of triggering a major breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in JCP if it manages to break out above some key near-term overhead resistance levels at $9.52 to $9.93 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average action of 16.89 million shares. If that breakout hits soon, then JCP will set up to re-test or possibly take out its next major overhead resistance levels at $10.30 to $12 a share.

Read More: 3 Stocks Spiking on Big Volume

Traders can look to buy JCP off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $8.50 to its 200-day moving average at $8.13 a share. One can also buy JCP off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Biodel

An under-$10 specialty biopharmaceutical player that's starting to trend within range of triggering a near-term breakout trade is Biodel (BIOD), which is focused on the development and commercialization of treatments for diabetes in the U.S. This stock has been hit hard by the sellers so far in 2014, with shares off by 30%.

If you look at the chart for Biodel, you'll see that this stock has been downtrending over the last two months, with shares moving lower from its high of $2.51 to its recent low of $1.85 a share. During that downtrend, shares of BIOD have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of BIOD have recently formed a double bottom chart pattern at $1.87 to $1.85 a share. This stock is now starting to bounce higher off those support levels and it's quickly moving within range of triggering a near-term breakout trade.

Market players should now look for long-biased trades in BIOD if it manages to break out above some key near-term overhead resistance at $2 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average volume of 150,944 shares. If that breakout kicks off soon, then BIOD will set up to re-test or possibly take out its next major overhead resistance levels at its 50-day moving average of $2.13 to around $2.20 a share. Any high-volume move above those levels will then give BIOD a chance to tag its 200-day moving average at $2.53 a share to even $3 a share.

Read More: 4 Biotech Stocks Breaking Out on Big Volume

Traders can look to buy BIOD off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support at $1.85 a share. One can also buy BIOD off strength once it starts to take out $2 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

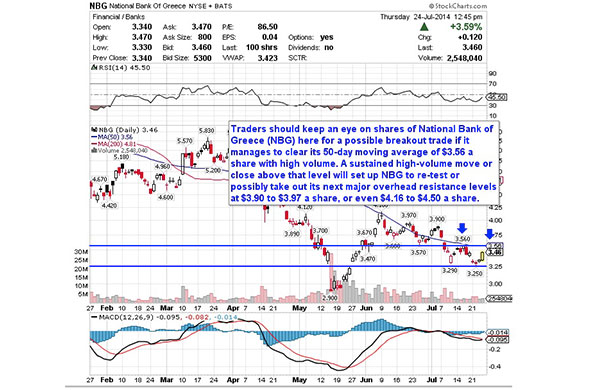

National Bank of Greece SA

One final under-$10 banking player that looks ready to trigger a big breakout trade is National Bank of Greece (NBG), which offers diversified financial services primarily in Greece. This stock has been rocked hard by the sellers so far in 2014, with shares down sharply by 38%.

If you take a glance at the chart for National Bank of Greece SA, you'll notice that this stock has been downtrending badly for the last two months, with shares moving lower from its high of $4.16 to its recent low of $3.25 a share. During that downtrend, shares of NBG have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of NBG have now formed a possible double bottom chart pattern at $3.29 to $3.25 a share. This stock is starting to rebound higher off those support levels and it's quickly moving within range of triggering a big breakout trade.

Read More: 3 Stocks Under $10 to Trade for Breakouts

Traders should now look for long-biased trades in NBG if it manages to break out above its 50-day moving average of $3.56 a share with high volume. Look for a sustained move or close above that level with volume that registers near or above its three-month average action 5.86 million shares. If that breakout materializes soon, then NBG will set up re-test or possibly take out its next major overhead resistance levels at $3.90 to $3.97 a share, or even $4.16 to $4.50 a share.

Traders can look to buy NBG off weakness to anticipate that breakout and simply use a stop that sits just below some key near-term support at $3.25 a share. One can also buy NBG off strength once it starts to take out $3.56 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>Hedge Funds Hate These 5 Stocks -- Should You?

>>5 Rocket Stocks Ready for Blastoff

>>5 Defense Stocks to Trade for Gains

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment